Turn your savings into an automatic and systematic machine

February 27 – March 3 is America Saves Week and while we don’t have Danny Zuko and the T-Birds to serenade you, we wanted to share some tips for getting you and your savings transformed from a clunker to an automatic, systematic (not really hydromatic) machine.

Systematic savings is the process of automatically setting aside a specific amount of your income on a regular basis, whether that’s weekly, biweekly or monthly. Rather than waiting to put money away when you have extra cash, with systematic savings you pay yourself first and make building your savings a priority.

You can get started by making your financial goals “SMART” goals. Your goals need to be:

Specific

Measurable

Attainable

Realistic

Time-Related

Financial goals should have a definite outcome and deadline and be within reach, based on your personal income and assets. For example, if you wanted to save $15,000 in the next five years it would require $3,000 in annual savings or around $58.00 per weekly paycheck.

One way to help achieve your “SMART” goal is so automate your savings. You can’t spend what you don’t see in your checking account, right? Set up your direct deposit to distribute a percentage of your paycheck to your savings account(s) and the rest into your checking account or have an automatic transfer from your checking account to your savings every paycheck, month, etc.

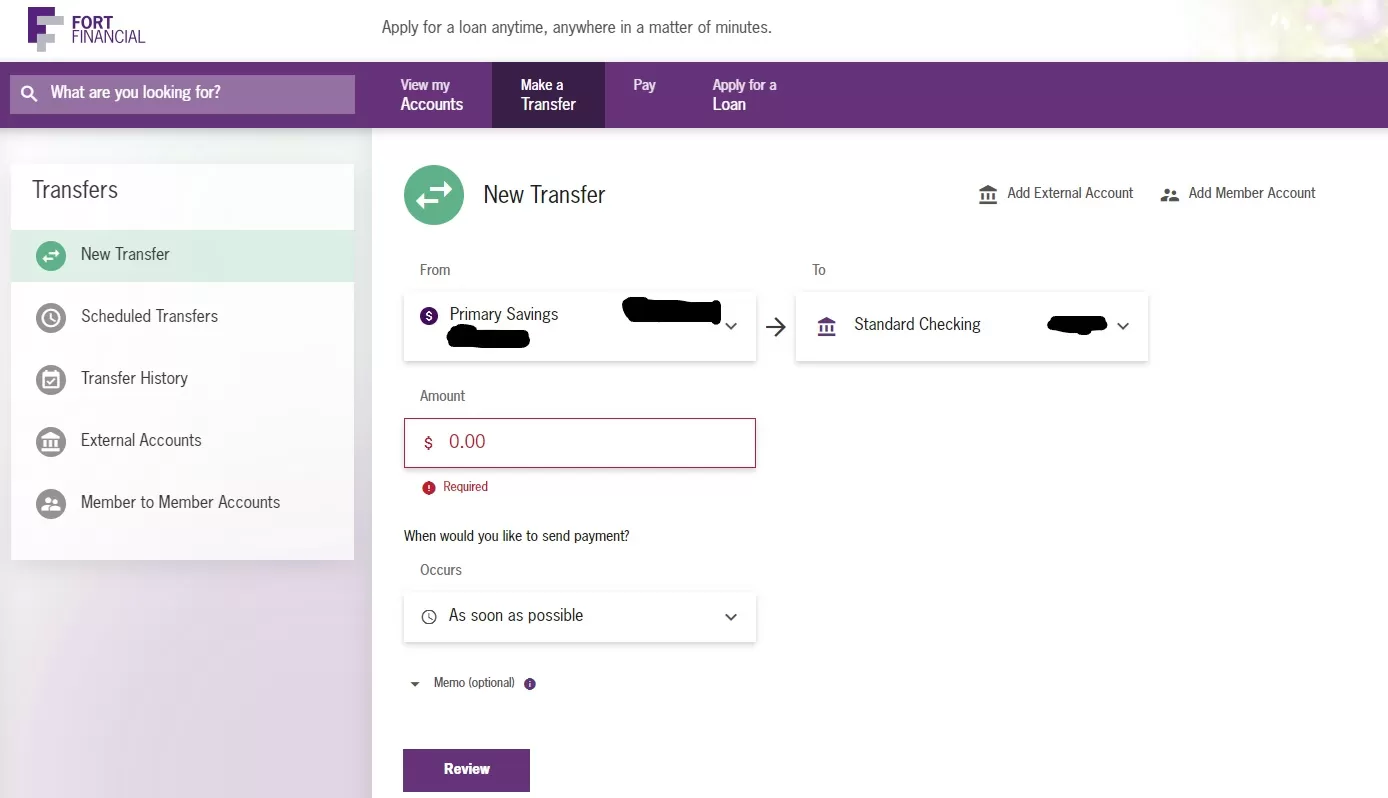

Did you know that you can set up automatic transfers in Fort Financial’s online banking portal? Simply log in and click the “Make a transfer” tap. Click the account you want transfer money from and the account you want to transfer money to, put in the amount and then specify when and how often you want this transfer to happen. You can even add a note to the transfer to help keep track.

Start small with your savings goal and build your way up as you go along. Every little bit helps, so whether you’re a beauty school dropout or alone at a drive-in movie theater, know that the first step of the journey to a healthy savings account can be just as fun as a summer night.

Developing a systematic savings plan can help put you on the plan to a more financially secure future. By putting away a set amount of money automatically on a regular basis ensures a portion of your income always supports your long-term savings plan, keeping you prepared for life’s financial emergencies.

Questions? We love to help you, no matter where you are on your financial journey, and be the one that you want (to do banking with). Stop by a branch or give us a call at 260.432.1561 and let us help you fortify your life.

« Return to "Blog"

- Share on Facebook: Turn your savings into an automatic and systematic machine

- Share on Twitter: Turn your savings into an automatic and systematic machine

- Share on LinkedIn: Turn your savings into an automatic and systematic machine

- Share on Pinterest: Turn your savings into an automatic and systematic machine